A trading and investing approach include believed and therefore whenever once you are creating a theory according to strategies you might have. Once you have made a theory, you develop trade laws and regulations, you down load historical analysis, and then you backtest the fresh change laws thereon study. Some other method exemplory case of speed step ‘s the in to the club development – a trading settings comprising a few bars the spot where the internal bar is contained inside the large and lower of your prior club. An inside bar usually is when locations try consolidating or perhaps before they start “exploding”.

Macro Cost savings Trade Actions

Of many brokerages allow you to unlock an investing membership having $0, even though you need sufficient money to begin with investing. Although not, should you understand a gain by the attempting to sell the brand new stock, you’ll owe investment gains taxation involved. If you buy and sell the new advantage inside per year, it can fall under quick-term money progress and will be taxed at the regular money taxation rate. For individuals who promote once you’ve kept the fresh advantage annually, then you definitely’ll spend the money for much time-label funding progress price, that is usually all the way down. For many who number a loss of profits, you might create one out of the taxation or facing your growth.

Understand as to why this particular service is continually rated an informed Stock Newsletter and find out the newest better efficiency the selections have hit vs. the marketplace. You’ve we hope explored a selection of methods that might has given you of use input about how to get started with change. As well, specific procedures use sophisticated modeling procedure and you will condition research you may anticipate possible Black Swan incidents and you may get ready consequently. That being said, it’s impossible to pinpoint the particular chance because the a great backtest is just an evaluation. Investors get to alter variables, make use of the brand new research source, otherwise hone their models so you can align that have market personality.

What is a real-life example of an inventory?

Similarly, Dividend Reinvestment Plans (DRIPs) allow you to instantly reinvest returns on the far more shares of one’s company. Applications including InvestingPro, or your own agent’s dash provide real-date condition to your collection results. Come across have that demonstrate gains/loss, investment allowance, bonus record, and you may income tax impact estimations. Explore equipment such as inventory screeners to filter out companies by the business cap, globe, earnings progress, otherwise bonus give. Of many brokers give dependent-in the screeners, but robust systems such as InvestingPro have the ability to focus on metrics aimed together with your needs (elizabeth.g., development vs. value). Benefits generally suggest allocating ranging from 10-20% of the immediately after-income tax earnings for assets such carries or bonds.

Pick from many various other profile so you can fulfill your goals. Generate plans you to definitely outlines those things simply take for achievement. Make sure that your plan is flexible and you can flexible in order to alterations in the marketplace. Funds and you may do well for the good Kiplinger’s suggestions about using, taxation, retirement, individual fund and. But you can discover as you invest by keeping your role models smaller than average by keeping a journal.

At the same time, if you’re also spending for a preliminary-name mission — below five years — your likely don’t wish to be invested in carries whatsoever. When you are using as a result of an excellent robo-coach, you’re going to have to figure out which you to definitely work at. Specific robo-advisors have very lower charges, and others let you talk with an economic advisor for those who you need additional help or maybe more customized suggestions.

Such platforms are specifically based to your taking a straightforward and you may easier way to purchase and you will trading brings. Additionally, this type of agents are really easy to aboard even via your cell phones and try appropriate student-amicable options. For individuals who’lso are having fun with https://profimaximizer.com/en/ an advisor — either individual otherwise robo — your obtained’t have to determine what to find. Such as, once you open a robo-coach membership, you’ll typically answer questions concerning your exposure endurance and when you you need your finances. Then robo-coach will generate your own profile and select the funds to expend within the. All you’ll should do is actually create money on the account, plus the robo-coach can establish their collection.

Some investors may use a mixture of one another answers to get a total understanding of the newest ties they have been trading. An internet brokerage account is all you to definitely’s necessary to begin committing to brings, common financing, and you will a variety of most other possessions. And this, when you have computed what kind of buyer or trader you want to getting, you are ready to determine a broker membership that’s best for your needs. The market are a general identity to the circle of exchanges, brokerages, and over-the-restrict locations in which traders buy and sell offers in the in public replaced businesses.

This may allow you to hone your change means and you will boost your overall results over time. Having effort and you can abuse, the newest traders can be use complex exchange devices and you can networks becoming far better and you will successful in the wide world of day change. The new large volatility of your places can result in generous loss if people don’t manage exposure effectively otherwise play with leverage unwisely. Concurrently, go out trade demands a significant time relationship and an intense information of the locations, and that is challenging for starters.

List money and you may ETFs tune a benchmark — such, the newest S&P five hundred or even the Dow-jones Industrial Mediocre — which means your fund’s efficiency usually echo one to standard’s results. If you’re also purchased an S&P five hundred list finance and the S&P five hundred try up, forget the might possibly be, also. The brand new S&P five-hundred is a catalog including from the five hundred of the largest in public areas traded enterprises on the U.S. Over the past half a century, its average annual come back has been pretty much a similar while the that of the market industry overall — from the ten%. Shared fund enable you to purchase quick pieces of many different holds in a single purchase. Directory money and ETFs is a variety of common finance you to track a collection; such as, an enthusiastic S&P 500 finance replicates you to list by buying the fresh stock of the companies inside.

- We’re perpetually curious and you may aggressive, mostly on the locations, but also which have our selves.

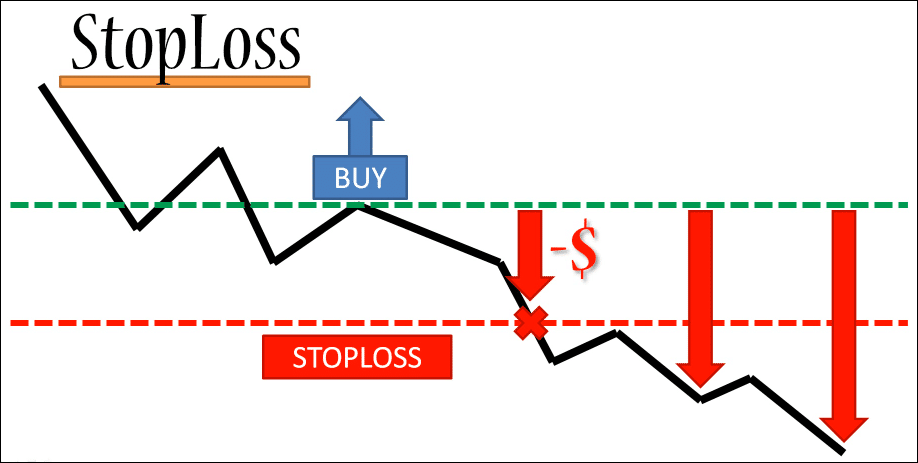

- Aim to follow this plan, specially when stock prices slide, since it can be tough in the second to choose if the you ought to hold on and you will loose time waiting for a rebound otherwise sell and you can reduce your losings.

- They does not only answer your concerns but usually even be in a position to pinpoint certain section you need to works for the.

- If you would like incorporate a reports change means into the date trade strategy, these fast-paced, high limits actions would be for you.

- A finite level of ETFs try subject to a purchase-dependent provider commission from $one hundred.

- A bid pricing is the highest matter your’re happy to pay to find a share away from a friends’s stock.

That may even be the way it is that have people, whether or not they may along with hold an inventory forever, operating a leading-flying stock for decades with no goal of ever before offering. Prices tend to fluctuate — very sometimes — that is why people would be to capture an extended-term strategy and you may very own a great varied collection away from stocks. Those who incorporate these simple steps usually appreciate an enriching experience while they gain benefit from the inventory market’s power to generate higher output you to substance over time.

Decide what to buy

Rapidly selling and buying bonds requires a sharp comprehension of the fresh industry and a more productive, hands-on the technique for exchange. Exchange-exchanged money (ETFs) are like shared fund in that they also pond money from people to find a great diversified portfolio out of assets. However, ETFs is actually exchanged for the stock exchanges, just like private stocks.

Just after a family happens public, their stock might be replaced in the second business through transfers or “non-prescription.” Over 58,one hundred thousand organizations global is actually publicly traded now. Anybody else find lowest-priced brings which can be attending obtain value, so they can promote from the a return. Nonetheless, other people would be looking that have a suppose in how kind of companies are focus on. That’s because you can vote in the shareholder meetings according to the amount of shares you own. Time buyers as well as for example stocks that are highly water for the reason that it provides them with the ability to alter their condition as opposed to altering the newest price of the fresh stock. In case your price actions off, an investor might wish to offer brief for them to money if this drops.

Maintaining-to-time on the most recent reports, monetary occurrences, and you can world manner is important to make advised exchange decisions. Ensure it is a practice to learn economic reports, follow industry analysis, and become advised about the enterprises and marketplace your’re looking for. Ahead of time trade, place a funds one reflects your financial situation and risk threshold. Be sure to spend some fund to have exchange that you could pay for to shed instead affecting debt stability. Prompt forward to today, and the stock market is known as main for the global economy, a change underscored by the financialization plus the increasing prominence away from monetary areas and organizations.